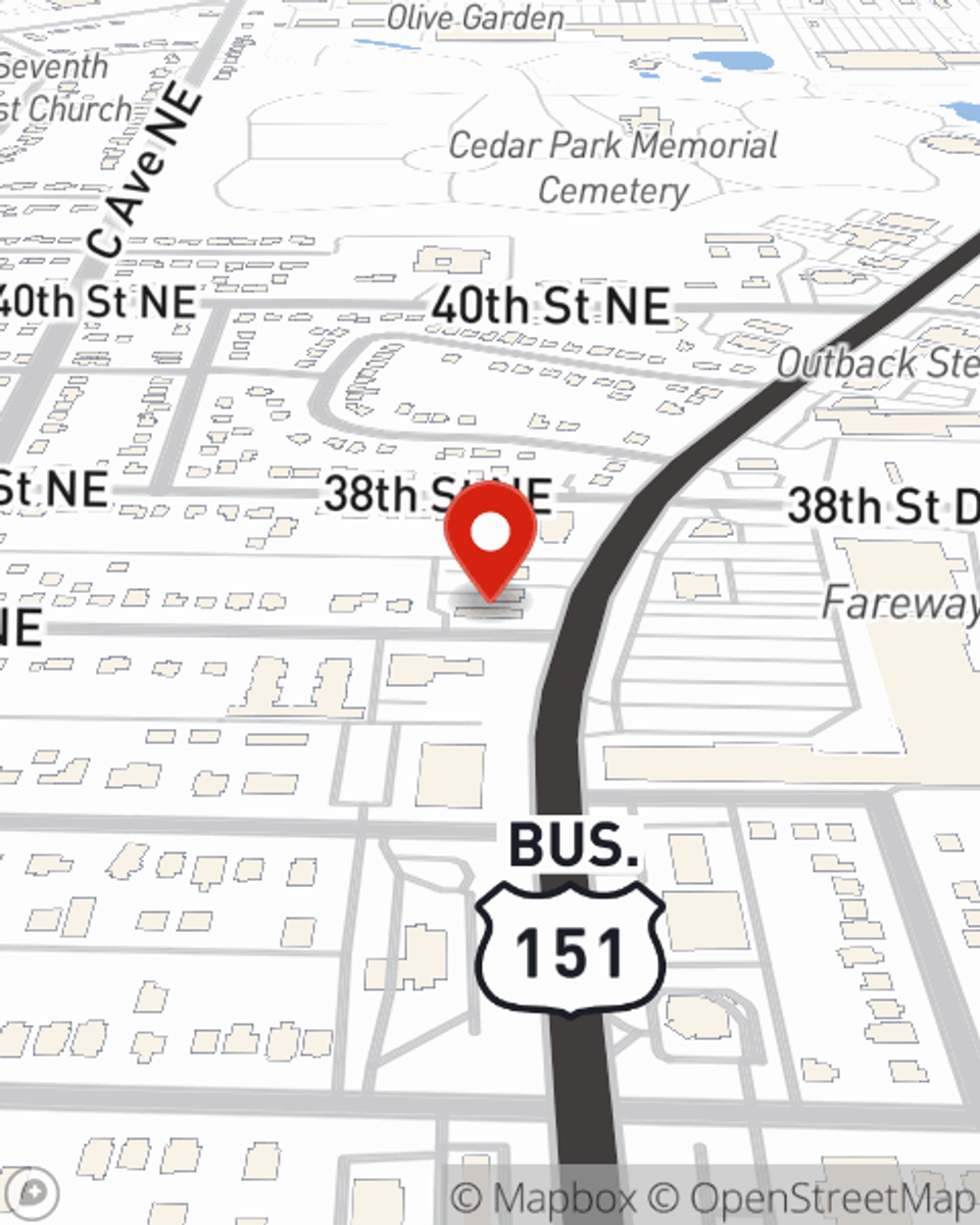

Business Insurance in and around Cedar Rapids

Looking for small business insurance coverage?

This small business insurance is not risky

- Linn County

- Eastern Iowa

- Marion Iowa

- Cedar Rapids, Iowa

- Fairfax Iowa

- Springville, Iowa

- Hiawatha Iowa

- Palo Iowa

- Iowa City Iowa

- Anamosa, Iowa

- North Liberty Iowa

- Tiffin, Iowa

- Belle Plaine, Iowa

Help Protect Your Business With State Farm.

You've put a lot of hard work into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a hearing aid store, a flower shop, a home improvement store, or other.

Looking for small business insurance coverage?

This small business insurance is not risky

Small Business Insurance You Can Count On

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Jim Humphreys. With an agent like Jim Humphreys, your coverage can include great options, such as commercial auto, business owners policies and commercial liability umbrella policies.

Let's review your business! Call Jim Humphreys today to see why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Jim Humphreys

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".