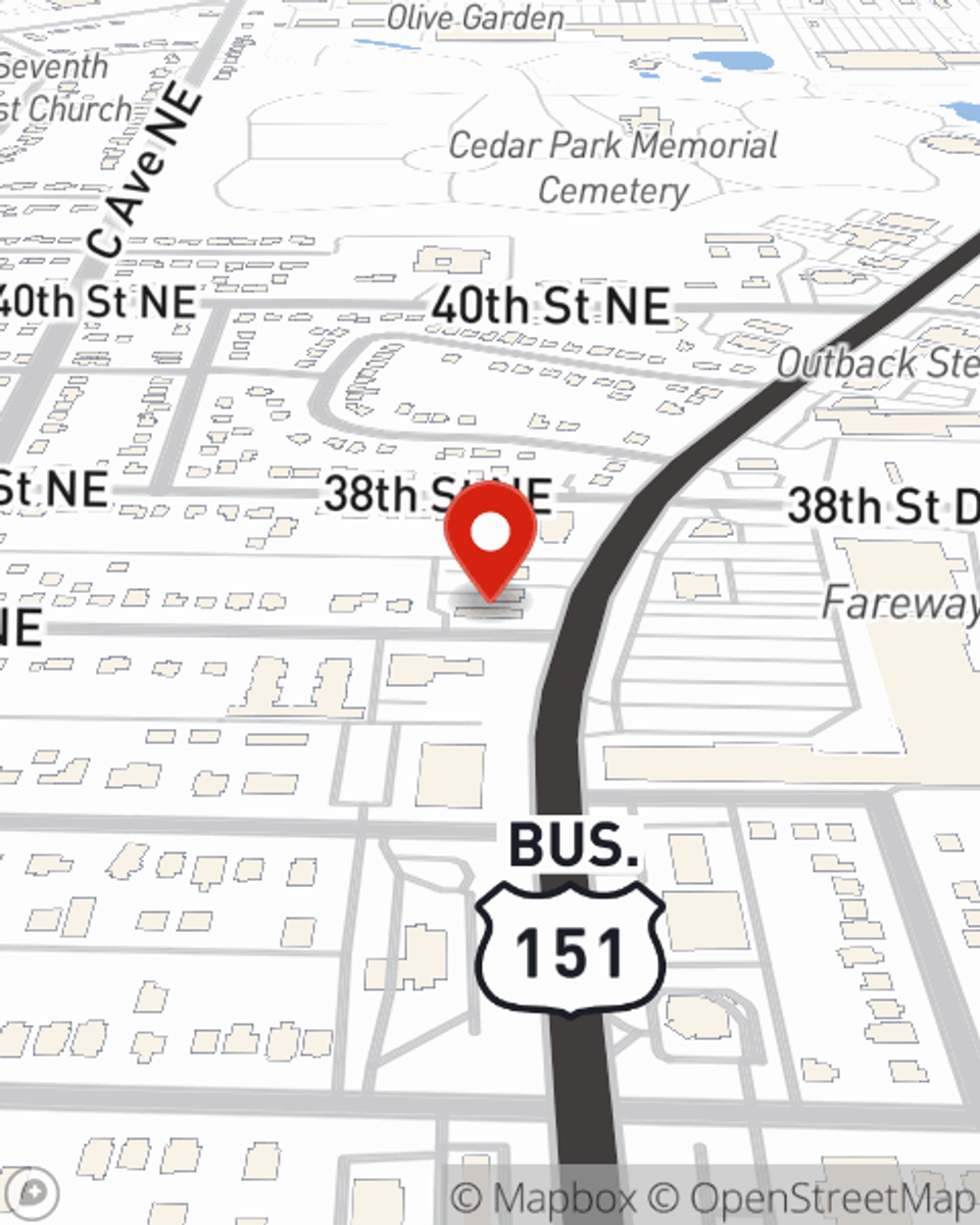

Life Insurance in and around Cedar Rapids

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Linn County

- Eastern Iowa

- Marion Iowa

- Cedar Rapids, Iowa

- Fairfax Iowa

- Springville, Iowa

- Hiawatha Iowa

- Palo Iowa

- Iowa City Iowa

- Anamosa, Iowa

- North Liberty Iowa

- Tiffin, Iowa

- Belle Plaine, Iowa

Check Out Life Insurance Options With State Farm

When you're young and your life ahead of you, you may think you should wait until you're older to get Life insurance. But it's a perfect time to start talking about Life insurance to prepare for the unexpected.

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

Love Well With Life Insurance

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With a protection plan from State Farm, you can lock in excellent costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent Jim Humphreys or one of their knowledgeable team members. Jim Humphreys can help design a protection plan adjusted to fit coverage you have in mind.

Regardless of where you're at in life, you're still a person who could need life insurance. Talk to State Farm agent Jim Humphreys's office to determine the options that are right for you and the ones you love most.

Have More Questions About Life Insurance?

Call Jim at (319) 363-2085 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Jim Humphreys

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.