Condo Insurance in and around Cedar Rapids

Cedar Rapids! Look no further for condo insurance

Cover your home, wisely

- Linn County

- Eastern Iowa

- Marion Iowa

- Cedar Rapids, Iowa

- Fairfax Iowa

- Springville, Iowa

- Hiawatha Iowa

- Palo Iowa

- Iowa City Iowa

- Anamosa, Iowa

- North Liberty Iowa

- Tiffin, Iowa

- Belle Plaine, Iowa

Your Belongings Need Protection—and So Does Your Condo.

Because your condo is your safe place, there are some key details to consider - needed repairs, cosmetic fixes, neighborhood, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you quality coverage options to help meet your needs.

Cedar Rapids! Look no further for condo insurance

Cover your home, wisely

Condo Unitowners Insurance You Can Count On

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has dependable options to keep your condo and its contents protected. You’ll get coverage options to accommodate your specific needs. Thankfully you won’t have to figure that out on your own. With attention to detail and terrific customer service, Agent Jim Humphreys can walk you through every step to help build a policy that secures your condo unit and everything you’ve invested in.

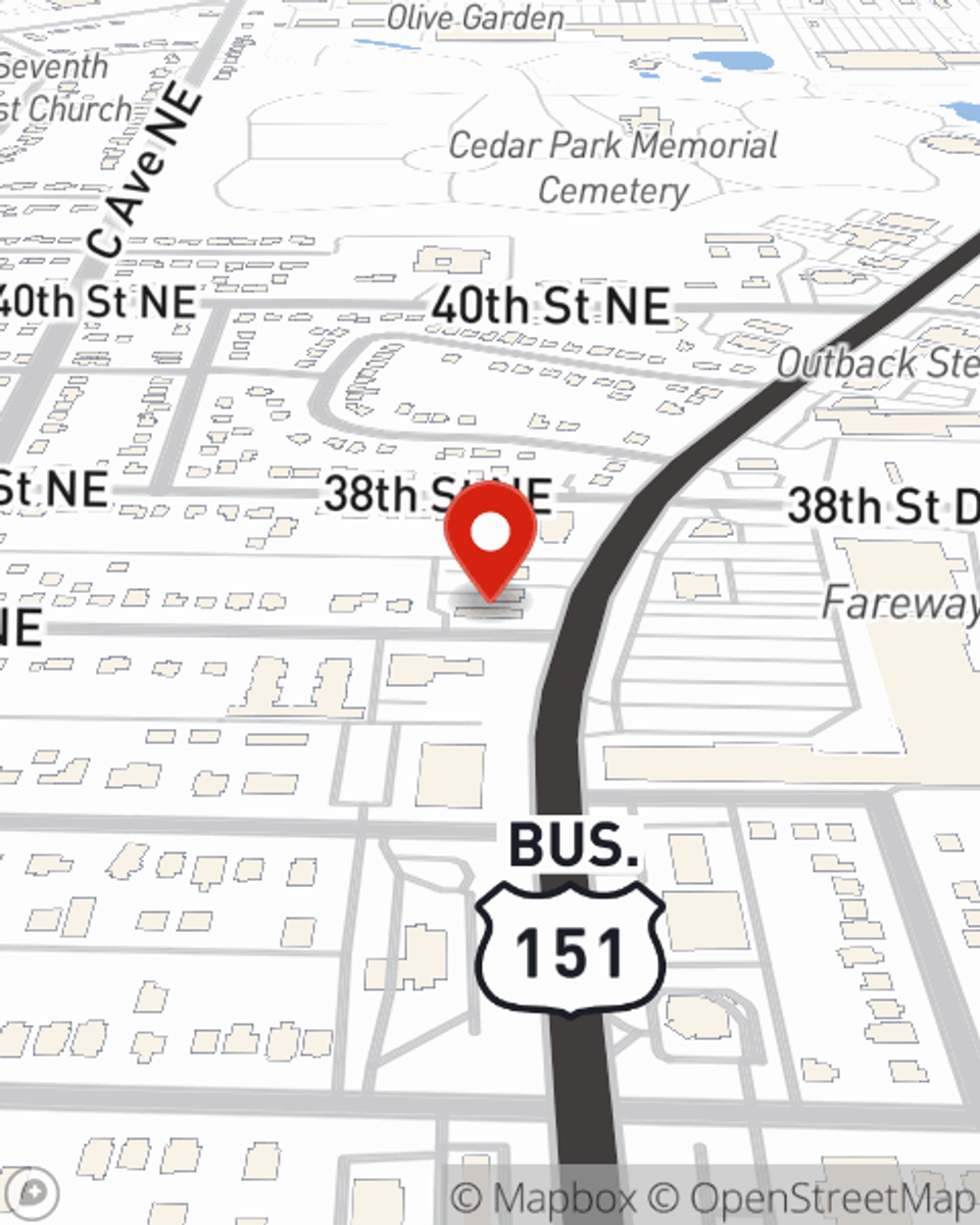

Getting started on an insurance policy for your unit is just a quote away. Visit State Farm agent Jim Humphreys's office to explore your options.

Have More Questions About Condo Unitowners Insurance?

Call Jim at (319) 363-2085 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Jim Humphreys

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.